Engagement & Retention project | Airbnb

Overview

What does Airbnb do?

Airbnb is a marketplace connecting travelers looking for places to stay with property owners who want to rent out either a part or whole of their space out in small periods.

Airbnb caters to these two broad segments by offering them unique services -

- For travelers: Airbnb offers a variety of accommodation options that can be cheaper and more unique than traditional hotels. Travelers can search for rentals based on location, price, amenities, and other criteria.

- For hosts: Airbnb allows people to earn extra income by renting out their space. The platform provides tools for listing properties, managing bookings, and communicating with guests.

What started off as two guys renting out air-mattresses from their apartment (that's the "air" in Airbnb) has now expanded into a full-fledged hospitality giant with a revenue of $10.24B (2024) and a market cap of $93.5B.

Airbnb is growing at a rate of 17.60% year-over-year, with the revenue majorly coming from the service fee that they make on every stay/experience offered on the platform.

Understanding Airbnb

What is their core value proposition?

Like we discussed earlier, Airbnb has two separate propositions for two segments of users. However, for this exercise, we will choose our core offering as -

Airbnb for Travellers

A snapshot from Airbnb's "Belong Anywhere" campaign

Airbnb's core value proposition is captured succinctly by this campaign -

Airbnb offers travelers unique, affordable accommodations that provide a more authentic and local experience.

Airbnb aims to offer something refreshing, a renewed experienced compared to what travellers get in hotels. They don't want to compete against hotels & resorts for mind-share, they are trying to define a new category.

How do users experience this core value proposition?

Users experience this core value prop when they complete the below steps -

- User creates their own account on Airbnb & signs on to the platform. 🔓

- User searches for a stay/experience which fits their requirements (price, location, views & other salient features). 🔎

- User finds a stay/experience of their choice, and books it via the platform. 💼

- User travels to the location and completes the trip, having experienced the experience they signed up for. 🤩

By completing this user journey, the user experiences the core value of Airbnb, and can be considered as an activated user.

What is the natural frequency of usage?

Casual users - Makes an Airbnb booking roughly 1-2 times a year, based on their unique requirements for each travel.

Core users - Makes an Airbnb booking 4-6 times a year, using Airbnb as their preferred form of stay.

Power users - Makes an Airbnb booking 10+ times a year - experiencing different Airbnbs is in itself a core interest for such users.

Does Airbnb have sub-products? What do they look like?

Airbnb can be categorized to have the below sub-products -

Sub-product | Core Value Prop | Casual User Frequency | Core User Frequency | Power User Frequency |

|---|---|---|---|---|

Homes | Interesting stays on local properties for an authentic experience | 1-2 times a year | 4-6 times a year | 10+ times a year |

Experiences | Unique activities & sight-seeing led by locals | 1-2 times a year | 4-6 times a year | 10+ times a year |

Icons 🆕 | Exclusive limited experiences focusing on pop-cultural icons from music, cinema etc. | Likely never | Once-in-a-lifetime | Once-in-a-lifetime |

As we can see, there are 3 sets of sub-products here, with Homes being the clear primary offering with Experiences being a secondary sub-product. Icons, by virtue of being once-in-a-lifetime limited experiences is a rare offering that will not be experienced by a majority of Airbnb users.

What is the best engagement framework for Airbnb?

We will use the below decision matrix to decide on the right engagement framework

Engagement Framework | What does it mean for Airbnb? | Decision |

|---|---|---|

Frequency | Number of trips/stays booked per year | Primary |

Depth | Average amount spent per trip booked | Secondary |

Breadth | Number of sub-products and features used | ❌ |

Let's dive into these in detail to understand the choices -

🥇 Frequency - Users who like the service prefer to book on Airbnb ahead of other places. This is an important success lever for retention, and a key indicator to track retained vs churned users.

🥈Depth - Simply put, customers who enjoy Airbnb services spend more time & money staying at the properties or using the experiences. They integrate deeply with the platform, using the features effectively and creating user flows that are personal to them.

❌ Breadth - While being a useful factor by itself, this does not drive Airbnb's revenue in the longer run as effectively as frequency & depth.

Customer Segmentation

Usage-based segmentation

User type | Frequency | Depth | Breadth | Typical ICP |

|---|---|---|---|---|

Casual 🚶♂️ | 1-2 times a year |

|

| The Budget-Conscious Traveller |

Core 🏃 | 4-6 times a year |

|

| The Unwinding Explorer |

Power 🧗 | 8+ times a year |

|

| The Digital Nomad |

ICP/Persona based Segmentation

Attribute | ICP 1 | ICP 2 | ICP 3 |

|---|---|---|---|

Persona | The Budget-Conscious Traveller | The Unwinding Explorer | The Digital Nomad |

Age | 25-40 | 25-35 | 25-40 |

Gender | Male/Female | Male/Female | Male/Female |

Annual Income | 10-30 lacs | 10-30 lacs | 20-40 lacs |

Marital Status | Married | Single/Married | Single/Married |

Do they have kids? | Yes | Yes/No | Yes/No |

Salaried/Self-employed | Salaried | Salaried/self-employed | Self-employed |

Do they work remotely? | No/Partially | Partially | Mostly |

Most used messaging app | |||

Most used social media app | Facebook, Instagram | ||

Other travel apps used | Booking, Agoda, GoIbibo | MakeMyTrip, StayVista, Booking | MakeMyTrip, StayVista |

How frequently do they travel? | 2-4 times a year | 5-6 times a year | 8+ times a year |

How many people do they usually travel with? | 1-5 | 1-4 | 2-6 |

How many days do they spend on a typical trip? | 3-4 | 5-6 | 10+ |

How frequently do they use Airbnb? | 1-2 times a year or less | 2-3 times a year | 6+ times a year |

How many people do they usually stay with in an Airbnb? | 3-5 | 1-4 | 2-6 |

How many days do they spend in an Airbnb trip? | 3-4 | 5-6 | Sometime up to a month |

How much do they spend per night on an average Airbnb trip? | Single/couple - 2000-3000 INR Family/group - 10000-12000 INR | Single/couple - 3000-4000 INR Family/group - 15000-25000 INR | Single/couple - 2000-3000 INR Family/group - 10000-30000 INR |

What is their favourite Airbnb feature? | Budget stays, unique stays, listing of amenities | Unique Stays, Host profiles, Experiences | Budget Stays, Host profiles, Experiences |

What do they dislike about Airbnb? | Unable to talk to hosts effectively, not always value-for-money, cancellation policies | Sub-par maintenance & experiences, safety & security concerns | Wants better pricing for longer stays, finds the options too limiting |

Casual/Core/Power | Casual | Casual/Core | Power |

Jobs to be Done

JTBD/Persona | The Budget-Conscious Traveller | The Unwinding Explorer | The Digital Nomad |

|---|---|---|---|

Primary Goal | Personal - Want to have a getaway with my family to decompress and spend quality time | Personal - Want to travel to different places and get a taste of local cultures & experiences | Social - Want to travel to places which I can showcase on social media |

Secondary Goal | Financial - Want the pricing to be appropriate and value-for-money | Social - Want to stay & travel to places I can showcase on my social media | Personal - Want to have a comfortable and safe stay |

Engagement Campaigns

Campaign #1 - Weekday boost! Get more out of your weekend getaway!

Attribute | Description |

|---|---|

Segmentation | Casual users (primary) Core users (secondary) |

Goal | Targeted Movement - Casual to Core, Core to Power Goal - Increase duration of stay by highlighting work-friendly stays & offering free days. Nudge users into booking weekend getaways on Airbnb. |

Metric targeted | Depth |

Pitch/Content | Weekends can't get longer, but your getaways sure can! Book a 3-day weekend getaway on Airbnb, and get 2 days on the house. Applicable on select work-friendly Airbnb's. |

Offer | A 3+2 days offer on booking a weekend getaway, to extend into the weekdays. |

Frequency & Timing | Timing - Starting two weeks ahead of long weekends Placement - On app open, notification on weekday evenings Frequency - Once a week during campaign duration (2-4 weeks) |

Channel(s) | In-app, push notifications, email |

Success Metrics |

|

Additional Metrics to track |

|

Thesis - Why will this work? | Casual & some core users typically weigh Airbnb's against other options when booking, and sometimes prefer hotels due to better service. When they experience a long stay at a work-friendly Airbnb, it builds trust & nudges them towards viewing Airbnb's as a better work-cation choice. |

Campaign #2 - Airbnb Timeline

Attribute | Description |

|---|---|

Segmentation | Core users (Primary) Casual users (Secondary) |

Goal | Targeted Movement - Core to Power Casual to Core Goal - Motivate users to book more stays with a gamified calendar year timeline of all Airbnb's you booked and stay in and adding offer for a milestone. |

Metric targeted | Frequency |

Pitch/Content | Introducing Airbnb Timeline - Your own personal map of Airbnb stays for each calendar year. Surprise stays - One free stay gets unlocked after 5, 10 and 12 paid stays in a year. |

Offer | A tailored free stay (user gets 3 options to pick from) after 5/10/12 paid stays in a calendar year. Airbnb algorithmically suggests stays you'll enjoy for a 2N/3N/4N booking based on your spend pattern in that year. |

Frequency & Timing | Timing - Campaign starts around early December Placement - On app open, push notification Frequency - Once a week during first 3-4 weeks of campaign, monthly/bi-weekly once afterwards |

Channel(s) | In-app, push notifications, email, social media |

Success Metrics |

|

Additional Metrics to track |

|

Thesis - Why will this work? | Users enjoy gamified experiences, especially when bundled with offers. "Not finding the right Airbnb" was a concern shared by many, which a well-designed algorithm should help solve. |

Campaign #3 - AirPass - Waive/reduce your service fee with Pass!

Attribute | Description |

|---|---|

Segmentation | Core users |

Goal | Targeted Movement - Core to Power Goal - Increase frequency of stays by addressing per-unit pricing concerns Incentivize booking on Airbnb ahead of other platforms by creating a loyalty/membership plan |

Metric targeted | Frequency Breadth (secondary) |

Pitch/Content | Introducing AirPass - your very own Airbnb membership! Avail discounts & waivers on your Airbnb service fee, with special prices on selected stays & experiences! Choose between 3-month, 6-month and annual plan. |

Offer | A membership plan that offers fee waivers for & discounted rates on Airbnb's |

Frequency & Timing | Timing - Ideally start during a lean season to improve traction Placement - On viewing a stay (show different prices for AirPass & regular members) Frequency - Once a fortnight initially, once a month later |

Channel(s) | In-app, push notifications |

Success Metrics |

|

Additional Metrics to track |

|

Thesis - Why will this work? | Core users tend to prefer & book more Airbnbs, but still weigh other options on price & availability. Offering them a membership plan that gives discounted rates & service fee waivers ensures that the price concern is removed, and users come directly onto Airbnb. |

Campaign #4 - Airbnb Leaderboard - Highlight your top travellers with feature & gamification

Attribute | Description |

|---|---|

Segmentation | Power users |

Goal | Targeted Movement - Motivate power users Goal - Motivate your power users to keep championing Airbnb by adding monthly showcases on the top travellers/hosts and a leaderboard to track power users who travelled to the most number of Airbnb's/spent most days in Airbnb's |

Metric targeted | Frequency |

Pitch/Content | Airbnb Leaderboard - Where the top travellers meet their match! Travel more, climb the leaderboard and build your own tribe! Airbnb Showcase - Every month, we feature a set of travellers who have climbed new trails, broken boundaries or just became one with the local culture of a new place. |

Offer | A leaderboard and showcase that boost power users and help them gain more followers |

Frequency & Timing | Timing - After completion of 3-4 trips in a year, show them climbing the leaderboard Placement - After trip completion |

Channel(s) | In-app |

Success Metrics |

|

Additional Metrics to track |

|

Thesis - Why will this work? | Power users are typically travel vloggers & ardent travellers who want to build a following for themselves using their Airbnb experiences. Both the leaderboard and showcase help them build this following & incentivize stronger usage of Airbnbs. |

Campaign #5 - Complete your trip on Airbnb & get rewarded!

Attribute | Description |

|---|---|

Segmentation | Casual users |

Goal | Targeted Movement - Casual to Core Goal - Increase depth of usage by gamifying the trip completion experience - Add your co-travellers, add to calendar, book an experience, leave a detailed review, add images & help out the community to achieve 100% completion on trips & get rewarded with Airbnb points that can be used on the next trip. |

Metric targeted | Depth Frequency |

Pitch/Content | Complete all the steps on your trip experience to get rewarded! Once you collect enough reward points, you can use them on a subsequent trip! |

Offer | A reward points mechanism that incentivizes users to deepen their travel integration with Airbnb |

Frequency & Timing | Timing - Starts when you complete your booking, with a guide on all the next steps to achieve trip completion. Placement - On the booking completion screen Frequency - Reminder to complete booking twice a week from trip booking until 2-3 weeks after trip completion (only if user has not taken the next steps) |

Channel(s) | In-app, push notifications (reminders) |

Success Metrics |

|

Additional Metrics to track |

|

Thesis - Why will this work? | Core users typically mentioned knowing & using most features of Airbnb, and agreed that this helped them gain more confidence in booking & preferring the platform. With this campaign, we attempt to get casual users to have a similar experience, which helps them gain more trust in the platform, which was a concern with many casual users. |

Retention Design

Bird's eye view

Airbnb is a part of the Travel & Hospitality category, which is notorious for lower retention & usage rates -

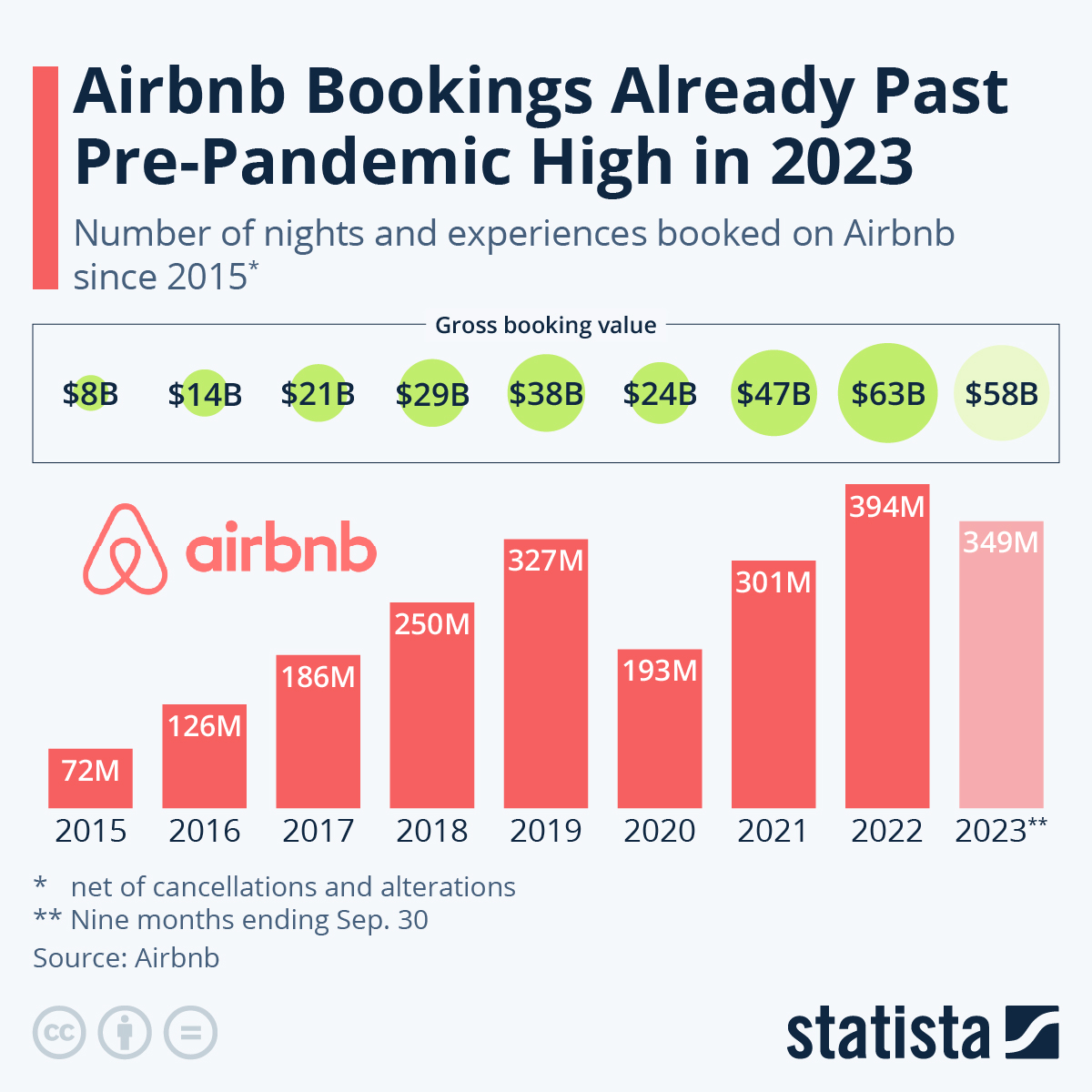

Source: Statista

As we can see here, travel resides amongst the lower end of the retention spectrum, with a mediocre retention rate curve.

However, as Airbnb hugely publicised during their IPO, their user retention rates across 5 years is much higher than hotels & resorts in the travel space, making them the valuable company that they are today.

Airbnb retains 40% of customers from the first year into the next, which continues down to 28% by the end of five years.

Using these metrics as a guideline, with Airbnb having generally better retention rates than other travel apps, we will plot the below retention -

As we can see, the retention curve starts flattering around Month 12, with users retaining on the platform consistently after 24 months.

Closer Look

Which ICP's drive the best retention?

Looking at Airbnb's Quarterly Report for Q1 2024, long-term stays of 28 days or more accounted for 17% of gross nights booked, and is constantly increasing.

Urban Travel remains one of the strongest levers driving both growth & retention, with customers also starting to move towards the non-urban travel destinations (increasing by 10% YoY).

In our user surveys as well, we find that the wi-fi wayfarers, the digital nomads, the freelancing, remote-working & travel vlogging community continues to love Airbnb for the convenience & facilities they offer. With Airbnb focusing on better pricing for long-term occupancy, this is a huge retention lever and a major ICP for retention.

This is followed by the community of active part-time travelers & weekend explorers who are trying to travel to interesting places within their busy schedules, making the most of each experience.

With this, we are able to conclude that the best retention is driven by ICP 3 - The digital nomad closely followed by our ICP 2.

Which acquisition channels drive users that retain better?

Based on conversations with users, the best retention is driven by -

- Referrals (corroborated by 50% of retained active users surveyed) - Users that were referred by their friends/family and started using Airbnb end up liking the product much more.

- Organic Search (corroborated by 40% of retained active users surveyed) - Users

What features drive the best retention?

- Budget Stays (corroborated by 80%+ of retained active users surveyed)

- Host profiles (corroborated by 75%+ of retained active users surveyed)

- Safety features (corroborated by 60%+ of retained active users surveyed)

Interestingly, "safety & security" has been identified as a feature that both drives retention and churn!

We need to find the correct levers to ensure this achieves the desired outcomes for both sets of customers.

Churn - how does it look for Airbnb?

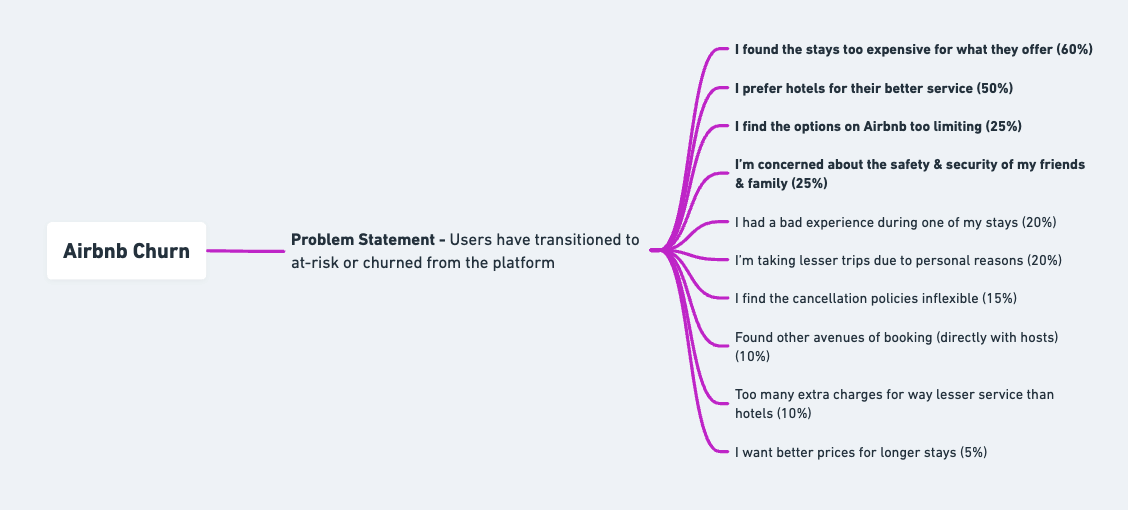

To understand churn, we go back to our user interviews & surveys where we tried to understand and focus on the reasons for user churn & significant reduction in usage frequency.

Top churn reasons

We asked churned & at-risk users for their top 2-3 reasons why they either dramatically reduced their usage frequency or stopped using Airbnb. Below is the distribution of responses -

Churn Bifurcation

Bifurcating this into voluntary & involuntary churn -

Highlighting our top 4 churn drivers, we find that two of them are voluntary churn reasons, while the other two are involuntary.

"I find Airbnb options too limiting" was classified as an involuntary churn, after discussions revealed that users did not find properties in desired remote locations & had other criteria that are beyond the purview & control of a marketplace.

What are the negative actions users take while transitioning to at-risk or churn?

Negative Action | Most Applicable Segment | Why does it matter? |

Significant reduction in trip frequency | Core & power users | Users typically start using Airbnb lesser when they find other options, displaying a clear dip in frequency. |

Highly negative/critical reviews on the stay/experience | All users | Users having bad experiences is one of the leading reasons for churn. |

Safety-related support ticket raised | All users | Safety & security is a common concern raised especially by casual/sections of core users that needs immediate addressing. |

Bad reviews on Play Store/App Store | Casual users | New & casual users instinctively respond negatively on the App/Play store when they have a negative experience. |

Fewer app opens | All users | When users stop opening the platform as much as they used to, it signals a mental shift to other products & competing services. |

Cancellation of booked trips | All users | Users spoke about potentially booking the same properties directly with the hosts, which is one of the involuntary churn reasons. |

Inactive Wish lists | All users | Users spoke about using the wishlist feature a lot when they are shortlisting properties, so inactivity on this section is a signal for future churn. |

Non-renewal of expired cards/payment options | All users | Committed users usually go ahead and renew expired payment options. Hibernating users may not do the same. |

Removal of saved cards/payment options | Core/casual users | This is a clear sign of lowering commitment, which needs to be tracked strongly. |

Removal of profile images/other information | All users | Another clear sign of lowering commitment. |

Resurrection Campaigns

Campaign #1 - Start again, Start small.

Attribute | Description |

|---|---|

Segmentation | Segment - At-risk users Ideal cohort - Users who have expressed concerns on the pricing in reviews, not booked a trip for close to 12 months |

Goal | Goal - Restart trip activities by suggesting discounted nearby budget stays for users who have not booked for >6-8 months after expressing concerns on price in older reviews. |

Pitch/Content | Start again, start small! Look at cozy budget stays right next to <user city/town>. Your weekend getaway beckons! 🚗 |

Offer | Discounted nearby stays for an easy weekend getaway |

Frequency & Timing | Fortnightly notifications on Thursday/Friday evenings |

Channel(s) | Push notifications |

Success Metrics |

|

Thesis - Why will this work? | Users expressed that they did not find properties at a good price when they were looking for nearby stays, and this caused them to go for hotels/other platforms. Identifying the ideal stays & nudging at-risk users when these stays are unoccupied will drive delight for both travellers & hosts. |

Campaign #2 - Clean House Campaign

Attribute | Description |

|---|---|

Segmentation | Segment - Churned users Ideal cohort - Users who have expressed concerns on safety & security or have had bad experiences in their last stay. |

Goal | Goal - Resurrect users who have churned due to negative experiences with their hosts/stays. |

Pitch/Content | We've cleaned house! Come back and experience the charm! We heard you - stays that posed safety & hygiene concerns have been removed from the platform. To ease you back in, we've added two discount vouchers that can be used on your upcoming trips. |

Offer | Discount vouchers for 2 upcoming trips (valid for 180 days) |

Frequency & Timing | Fortnightly notifications, at least 2 weeks after user has been considered as churn |

Channel(s) | E-mail, push notifications |

Success Metrics |

|

Thesis - Why will this work? | Users expressed concerns on security/hygiene especially when they wanted to book a family trip. They wanted to be "safe" with their choices, which we solve for by telling them explicitly that certain stays have been removed** |

**Airbnb have actually removed stays for these reasons, and have published it as part of their investor report.

Campaign #3 - Cancel with confidence!

Attribute | Description |

|---|---|

Segmentation | Segment - Users who transitioned down from Core to Casual or Casual to At Risk Ideal cohort - Users who have reduced their bookings dramatically, potentially due to inflexible cancellation policies |

Goal | Goal - Incentivise users to start booking more confidently as we have better cancellation policies now. |

Pitch/Content | Not sure of your trip dates? Worry no more! With our free cancellation, you can cancel any trip with a complete refund. |

Offer | Free cancellation up to 72 hours before trip start on all stays booked during offer period. |

Frequency & Timing | Frequency - Twice a week. Timing - Few months after booking frequency has reduced |

Channel(s) | Push notifications, in-app while browsing options |

Success Metrics |

|

Thesis - Why will this work? | Users reduced their booking frequency due to the inflexible cancellation policies, which when reversed (even briefly), will motivate them to start booking again. When these users are back to their original cohorts, we can continue to support free cancellation with updated terms to ensure a fair marketplace for both hosts & travellers. |

Campaign #4 - Stay Longer campaign.

Attribute | Description |

|---|---|

Segmentation | Segment - Users who transitioned down from Power to Core or even further Ideal cohort - Users who were regularly using long-term stays but have stopped recently |

Goal | Goal - Bring back power users who were using long-term stays by offering more competitive longer-stay pricing |

Pitch/Content | We've missed you! Come back for another long-term stay with Airbnb, now at prices never seen before. We listened - Long-term stays are now more competitively priced, to ensure our wi-fi wayfarers are charged up, all month long. |

Offer | Discounted long-term stays |

Frequency & Timing | Weekly notifications, once power user has been identified as being at risk. |

Channel(s) | Push notifications |

Success Metrics |

|

Thesis - Why will this work? | Power users mentioned that they would like to see better long-term pricing to help them make such bookings. This is a targeted campaign aimed at bringing them back to the platform, as they have already engaged deeply with Airbnb & only need validation that their concerns are heard. |

Campaign #5 - Let Airbnb serve you better.

Attribute | Description |

|---|---|

Segmentation | Segment - At-risk users (preferably from core) Ideal cohort - Users who have expressed concerns on high service & cleaning fees in reviews |

Goal | Goal - Resurrect users who found the service fees too high, by providing a milestone-based fee discounting mechanism |

Pitch/Content | Exclusively for you! We're discounting your service fee for the next three trips. How to avail the offer - Waiver on the first trip, with two discount coupons unlocked after first trip completion |

Offer | Waiver on first trip and 50% discount on the next two trip service fees (to be used in 6 months) |

Frequency & Timing | Weekly notifications, 2-4 weeks after user has been deemed at-risk. |

Channel(s) | E-mail, push notifications |

Success Metrics |

|

Thesis - Why will this work? | Users were unhappy with the value provided vis-a-vis the service & cleaning fees, which caused them to go back to hotels. By reducing this burden, we help them start viewing Airbnb positively again, and start using the platform for their trips. |

Closure

With that, we arrive at the closure of Engagement & Retention analysis for Airbnb.

We all need a break now, don't we?

Thanks for reading!

Deepak Shravan K S

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.